Introduction

Managing money has never been easier—or more important—than in 2025. Thanks to advanced AI, real-time analytics, and secure cloud tech, finance apps now help users track spending, save smarter, and even invest automatically.

Here are the Top 4 finance apps redefining personal finance in 2025.

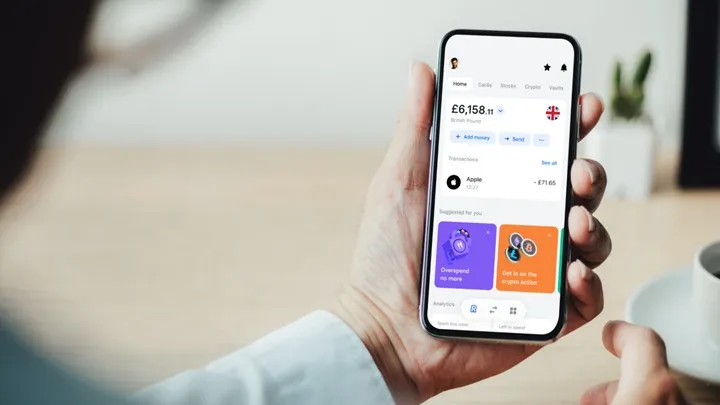

1. Revolut – All-in-One Digital Banking

Revolut continues to dominate the fintech scene with its all-inclusive financial tools.

Key benefits:

- Multi-currency accounts with low exchange rates.

- Real-time spending analytics and budget insights.

- Built-in crypto trading and stock investing.

- Top-tier security with instant card freeze/unfreeze.

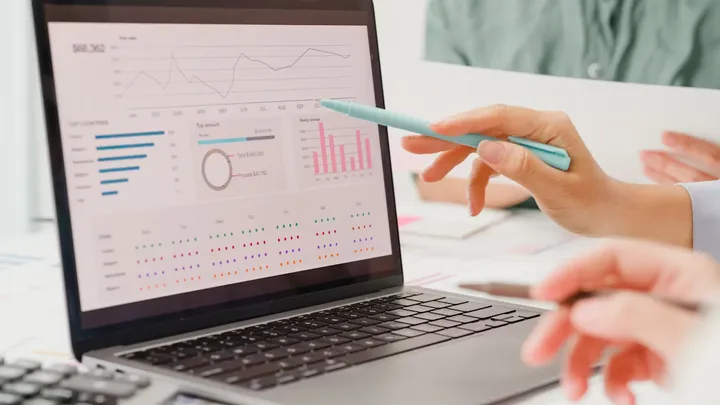

2. Mint – Budgeting Made Simple

Mint remains one of the most popular apps for everyday budgeting and expense tracking.

Key benefits:

- Automatic expense categorization.

- Personalized budget goals.

- Bill reminders and credit score tracking.

- Intuitive dashboard for visualizing your finances.

3. Robinhood – Easy Investing for Everyone

Robinhood revolutionized trading, and in 2025 it’s better than ever.

Key benefits:

- Commission-free stock and crypto trading.

- Educational tools for new investors.

- Custom alerts and real-time market insights.

- Clean, easy-to-use interface for mobile investing.

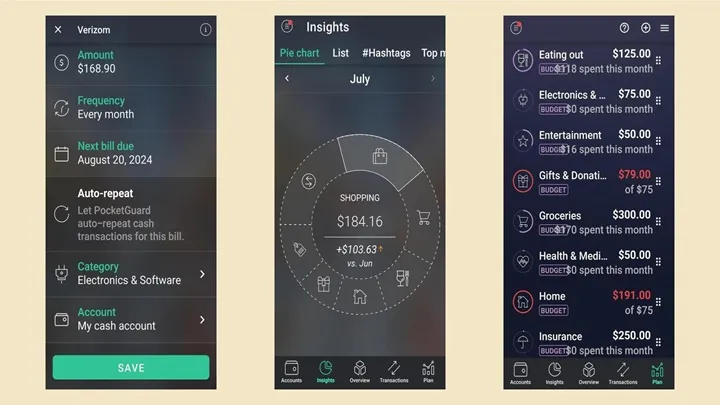

4. PocketGuard – Track and Save Effortlessly

PocketGuard helps users take full control of their spending habits.

Key benefits:

- “In My Pocket” feature shows how much you can safely spend.

- Automatic connection to your bank accounts.

- AI-based spending analysis and tips to save more.

- Protects your data with bank-level encryption.

Conclusion

In 2025, managing your money is no longer about spreadsheets—it’s about smart automation and transparency.

From Revolut’s all-in-one banking to Mint’s budgeting simplicity, Robinhood’s accessible investing, and PocketGuard’s spending control, these apps empower you to master your finances with confidence.